Ten years ago, in January of 2000, the decade of the 1990’s had just ended and the S&P 500 Index had just produced a ten year compound annual return of 18.2%. Moreover, it had just completed an unprecedented run of five years in a row of returns in excess of 20% per year. Many investors had begun to expect stock market returns of 15% or more per year in the long run. In our Review & Outlook at the time, we quoted Warren Buffett saying “People aren’t going to average 15% or anything like it in equities”. Our own comment: “The long term return [for stocks] from this point is highly likely to be well below the unusually high returns experienced these last 15 years or so.”

In the ten years that followed (and that have just ended), the compound annual return of the S&P 500 was -0.95% per year. Many investors are now ready to give up on stocks and money flows are surging into bond funds.

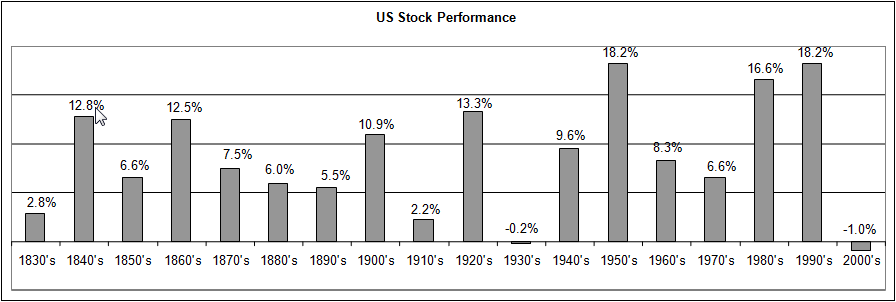

Markets can be highly variable in the short run, but produce relatively more consistent results in the long run (obviously, “the long run” in this context means periods quite a bit longer than ten years). This tendency for market returns to even out over time actually has a name: “mean reversion”. This implies that after a five or ten year period of well above average returns, the next five or ten years are likely to produce below average returns so that longer term returns “even out”. And vice versa: intermediate periods of unusually poor returns are likely to be followed by periods of better than average returns. Here is a chart of stock compound annual returns by decade:

*Source: Yale International Center for Finance, New York Stock Exchange, Ibbotson, S&P 500.

Two facts leap from this data. First, the calendar decade that just ended was the worst ever for US stocks (one of only two that were negative). And second, we see that tendency toward “mean reversion”.

In fact, we find that for the seven best decades in which stock returns were more than 10% per year, the average return in the following decade was only 6%, which is below the average for all decades of about 9%. Conversely, for the seven worst decades where stock returns were lower than 7%, the average return in the next decade was 11.6% per year, a well above average return.

Since the decade that just passed was the worst calendar decade for US stocks ever, if other things were equal, one might expect better than average returns over the next ten years as a whole.

However, things are never equal, and market returns ahead are likely to be hampered by today’s less than attractive valuations. The dividend yield of the S&P 500 is only 2%, whereas it has averaged closer to 3% in the long run. Regardless of the rate of dividend growth over the next decade, if the market’s dividend yield climbs to 3% over the period, that valuation adjustment would shave 4% per year off whatever returns would otherwise have been achieved.

Moreover, future dividend growth (and earnings growth) for the market is highly uncertain given government policies resulting in “unfulfillable entitlement promises and unsustainable budget deficits” (George Will). In fact, just this month, the firm Eaton Vance made the point that if no changes are made to current law, in just nine years, 100% of the federal budget will be required to pay just Social Security, Medicare, and interest on the federal debt! Clearly, with that kind of train wreck looming, changes will be made, likely to include higher tax rates, even more borrowing, and perhaps higher inflation between now and then. Higher tax rates translate to lower growth, more borrowing is likely to result in higher interest rates at some point, and both reduce stock returns.

Extreme negative sentiment about an asset class is generally a harbinger of better returns ahead (and nothing creates negative sentiment like the worst calendar decade in history). Many people may be too negative in their long term outlook for stocks, and it’s unlikely that the “lost decade” will be immediately followed by another decade of such unusually poor returns. On the other hand, valuations and policy issues are such that we find it difficult to expect stock returns over the next decade to be well above average either. We would also expect significant cross currents along the way (i.e., volatility). However, volatile yet middling returns in the 2010’s, if achieved, should still be a welcome improvement from the volatile yet negative returns of the decade just past.