Risk is a critically important concept in investing. Many investors give risk too little attention after times when risk has recently been contained, and many focus too much on risk after it has jumped into headlines and grabbed their attention. Many of our comments along the way are designed to help investors keep a more even-keeled perspective of risk and to avoid the swings that are so common.

But beyond the problem of investors’ waxing and waning attention to risk, there is an even more fundamental problem with the perception of risk, which is: What is risk? Most investors think of risk too narrowly, defining risk in investing as the prospect of declines in the value of their investments. That type of risk is generally called market risk, and it is certainly an important aspect of risk, but it is not the full picture by any means.

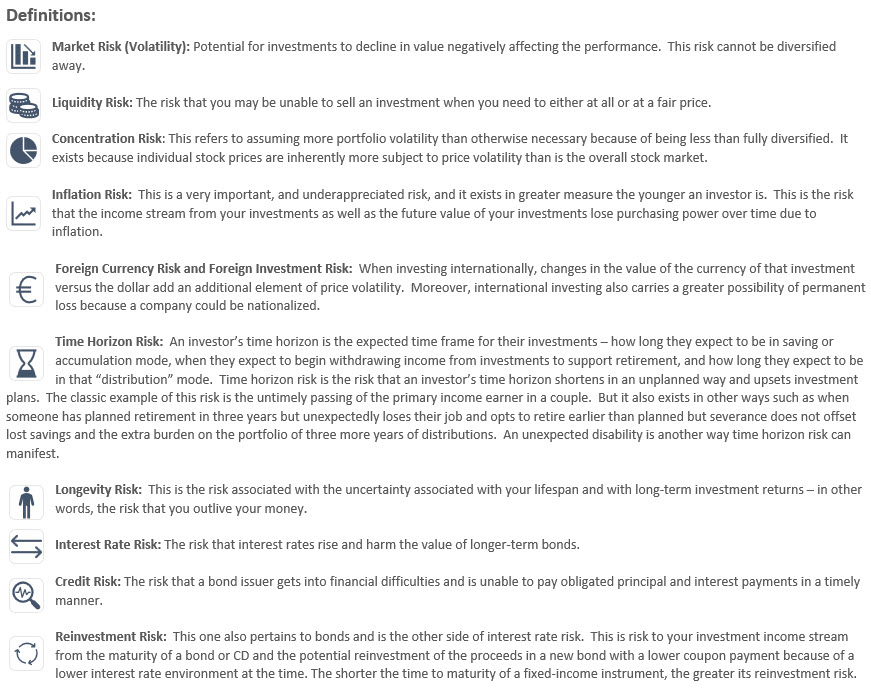

This is not an exhaustive illustration of the different types of risk investors face – and need to manage – but it serves to demonstrate that risk involves far more than declines in value (definitions for reference can be found at the bottom of the article):

The important thing to understand is that many different types of risk operate at once and that it’s impossible to eliminate all types of risk at the same time. For example, you can eliminate market risk by holding only short-term T-bills or bank CDs, but that greatly increases your reinvestment rate risk since the income generated will decline when interest rates drop, and the lower returns generated increase the risk that you outlive your money.

You can greatly reduce reinvestment rate risk and mitigate longevity risk by holding very long-term bonds instead of short-term T-bills (or other “money market” instruments), but that greatly increases the volatility in the value of your portfolio since the value of long-term bonds falls when interest rates rise. Moreover, that also greatly increases your exposure to inflation risk since the income stream from long term bonds, also known as “fixed-income” investments, is … fixed.

Since stocks in the aggregate have a strong history of rising dividend payments over time, that increasing income stream reduces both inflation risk and longevity risk in a portfolio, but it comes at the cost of greatly increasing its market risk.

We could go on, but you get the idea: each type of investment (including “cash”) comes with certain advantages and disadvantages. All are good at mitigating certain types of risk and all are very exposed to other types of risk, and no one type of investment is immune to all types of risk. That means there exists no combination of investments that eliminates every type of risk. At best the various types of risk can be mitigated in a balanced way. Fortunately, some types of risk are of more consequence to investors in certain circumstances and are less important to others so investors (or their advisors) can focus on reducing the most important types of risk for a given client by assuming other risks that in their case are less important.

Moreover, many investors find their attitudes about risk change over time. In strong markets, investors may tend to lose sight of the importance of managing risk, market risk and otherwise, and wish they had embraced more market risk while underappreciating the market risk mitigating benefits of cash, bonds, and other diversifiers. In weak markets, they may lose sight of the good reasons to accept some market risk in the service of reducing inflation risk and longevity risk.

These are just illustrations that risk is complex and multi-faceted. The most important task of an investment manager is to manage risk in all its dimensions in a balanced way which accounts for the unique circumstances, needs, and preferences of the investor.