“New Year’s Day is the morning of the year. Like the mornings of mere days, it inspires fresh hope, but on an immensely grander scale.”

-my friend Chris Flannery, from his fine talk at Hillsdale College, reprinted in “Imprimis,” Dec. 2022

“Having lived 81 years, I’ve learned to trust only dogs and the bond market.”

-my friend Bob Faaborg, who claims this isn’t original (but can’t identify the source)

Recap and Outlook:

2022 brought the worst year for stocks since the 2008 Financial Crisis. The total returns for the S&P 500 Index and for the “Blended Stock” (global) Index were each -18% for the year, while non-US stocks1 were down 16%. REITs were down 25%. It was the worst year for bonds since 1976 as taxable bonds returned -13%. For a 60/40 blend of US stocks and bonds, it was the worst year since 1936. Inflation soared to a peak of just over 9%, its highest reading in 41 years, and bond yields jumped as the Federal Reserve pushed up short-term interest rates at its fastest pace ever to their highest level since 2007. It was a year most investors were pleased to bid goodbye.

That combination might typically compel some investors to give up on patience with “long-term” investing and give in to the urge to “get out” of the market (wreaking havoc, of course, with long-term financial plans). Fortunately, we’re not seeing that panic among clients now. We’d like to think that’s because we’ve done such a good job communicating, but we know better – it’s mostly that in 2022, client portfolios generally experienced much smaller declines than those of the overall market as a prudent, disciplined investment approach happened to have had an exceptionally good (relative) year. That’s great now. But next year could be entirely different.

Therefore, we’d prefer to take an encouraging tone here, assuring clients better days for markets must surely be at hand. We noted stock valuations were too high a year ago, and we know a correction in high valuations is a long-term positive going forward. We all understand occasional bad years for markets go with the territory of investing, and that bad market years tend to be followed by better years. And possessing that natural optimism that surrounds the opening of every new year, we want to be more positive now. But, while the short-term is always anyone’s guess, we don’t believe we’re “there” yet because of the strong potential for a recession-related earnings dip and, unfortunately, we think it more likely than not that at least the beginning of 2023 may not provide much relief.

Last year, markets were driven by high inflation, soaring interest rates, and surging geopolitical risks. Some expected a recession in 2022 and indeed economic growth stalled in the first half, but the labor market stayed strong, and the economy grew for the year. As we turn into 2023, inflation remains too high (though it may have at least temporarily peaked), while the likelihood of a recession in 2023 has grown. Whether the year brings a recession or not, many expected it to bring at least a decline in corporate earnings. The current consensus, which has been declining, now calls for low single-digit earnings growth for the S&P 500 in 2023. In 2022, stock prices fell as earnings rose, bringing market valuations rapidly down from overvalued heights at the beginning of the year to levels now more in line with long-term norms (by some measures). But stocks don’t seem to have adjusted to discount likely lower earnings ahead yet, so it appears to be too soon to sound the “all clear” for stocks.

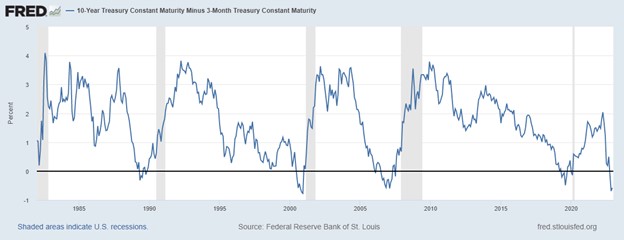

While stocks may be trading as if a recession may be avoided, the bond market is waiving a big recession flag. Those that expect a recession this year do so in part because the “yield curve” is now meaningfully “inverted.” This means short-term interest rates (set by the Fed) are significantly higher than long-term interest rates (controlled by the market). This condition of an “inverted yield curve,” is considered a reliable forecast of recession. In fact, it may be more than a forecast: it may simply signal that the Fed has already been tight enough to cause a recession. Here’s the history of the yield curve since 1982 (data from the Federal Reserve, light gray vertical lines indicate recessions, which you can see followed yield curve inversions without fail for the past 40 years):

With stock and bond markets now at odds, something has to give. Unfortunately, in such cases, the bond market is generally the more reliable. On the other hand, if a recession is nearly upon us, it will be like none other as the previously mentioned labor markets have remained quite strong. We’ll see.

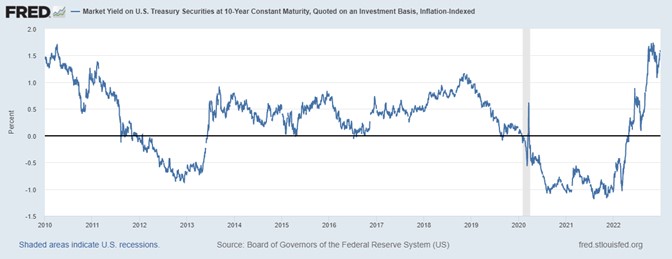

The most unambiguous positive for portfolios we see here is that bonds now offer their best yields since the Fed first imposed zero percent interest rates. Taxable money funds at Schwab now pay 4.27%, and the 10-year Treasury note that paid 1.52% a year ago now yields 3.77%. It took an ugly year in the bond market to get here, but the silver lining is that meaningful income is again being generated from cash and fixed-income securities. Perhaps the best measure of yields in excess of inflation expectations is the yield on US Treasury Inflation Indexed Bonds (TIPs), and here is that yield history since 2009 (again, data from the Federal Reserve):

However, significant risks now include: Will the Fed overtighten into a weaker economy? Will we have a more severe recession or something milder or rolling – perhaps not affecting all sectors of the economy at once? Additionally, and importantly, will the Fed read it all perfectly and pull back monetary restraint in the nick of time to avoid recession while still succeeding in bringing down inflation? That may be possible but count us skeptics. The series of Leading Economic Indicators just turned negative. And with the latest data (for November), year-over-year growth in the most common measure of the Money Supply (M2) declined to 0%. This matters because money supply growth in excess of nominal GDP growth tends to boost the economy while slower money supply growth is an economic drag. For context, M2 annual growth was over 20% from July 2020 through May 2021 (peaking at +27.1%!), and since 1982 (the earliest data we have), M2 growth has only been (slightly) lower than 0% for two months (both in 1993). The “bill” for massive over-stimulus in 2020-2021 partly came due as inflation in 2022, and its second payment may well be recession in 2023.

Long-term Considerations:

We usually don’t dwell here on the very long-term, but conditions have been settling in for a couple of years which appear to be of unusual importance: With Russia’s February invasion of Ukraine, western economies virtually stopped trade with Russia, a significant exporter of oil, natural gas, wheat, and fertilizers. This inflamed disruptions to global trade at a time global supply chains were already reeling from Pandemic-related shifts in demand and from labor shortages related to both aging populations and to increased government transfer payments in several nations. Additionally, China escalated threats against Taiwan all last year. In November, Xi Jinping declared China was preparing for war. On 12/27, China sent 41 warplanes into Taiwanese airspace – its largest provocation in months. The West has been rapidly decoupling China from supply chains all year, with no apparent end in sight.

From the end of WWII until recently, growth in globalization was an economic constant. And from early 2009 through early 2022 (with a mild reprieve in 2017-2018), the other consistent theme was coordinated central bank easing and zero percent short-term interest rates. The connection: globalization reduced inflation which in part allowed central banks to hold interest rates so low for so long.

Now, all that has rapidly changed. The Pandemic, supply chain bottlenecks, Brexit, new tariffs installed by the former administration and kept in place by the current administration, heightened security concerns in response to aggressive actions from Russia and threats from China, aging populations, and subsidies for domestic production have combined to reverse globalization trends and open a race toward onshoring in areas from semiconductor manufacturing to call centers. “Just in time” inventory management now gives way to the more expensive but more secure “just in case.” Concurrently, global efforts to promote green energy have increased with expected long-term environmental benefits but with certain increases in near-term economic costs.

Collectively, these form a significant shift in global direction with profound implications: increased headwinds to long-term economic growth, and likely pressure on corporate profit margins for years to come, with increased costs and inflation. We don’t know how much lower inflation was historically than it otherwise may have been because of globalization in recent decades, but likely de-globalization into the future may be expected to add to inflation ahead. Moreover, if the foreseeable future includes lower economic growth, higher inflation, and higher interest rates, greater market volatility cannot help but be part of that package. Storied investor Howard Marks of Oaktree Capital Management notes all this too and recently called this combination a “sea change” for markets with likely impacts for years to come2.

Wrapping Up:

If near-term prospects merit continued caution, and if several tailwinds we’ve enjoyed for some time may now be shifting into persistent longer-term headwinds, where in this “morning of the year” may we find “fresh hope”? We don’t pay much attention to the Nasdaq Composite index because it’s quite Tech-heavy and not very representative. We seldom quote it here. But in 2022, with the Blend Stock index (and the S&P 500) each down 18%, and with our managed stock portfolios down substantially less than that, it may be worth noting that the recent darling Nasdaq Composite Index fell 32.5% in 2022.

It may be cold comfort to assert 2022 could have been much worse for client portfolios. But it’s real. A disciplined, prudent, cash-flow-oriented approach to investing has always been rewarded in the very long run, but it can and has gone out of favor for uncomfortably long stretches at a time. The ten years or so ending in late 2020 was a painful and recent example. But that pendulum turned over two years ago, and client portfolios fared unusually well on a relative basis in 2022. With the prospect of near-term risks and long-term headwinds for markets, this looks like an ideal environment for continued generally positive relative performance for our investment approach. So, through gathering clouds, we’ll gratefully cling to that significant little ray of hope as we turn the page on a new year and wish you a happy, healthy, and prosperous 2023!

1 The MSCI All Country World ex-US Net

2 https://www.oaktreecapital.com/insights/memo/sea-change