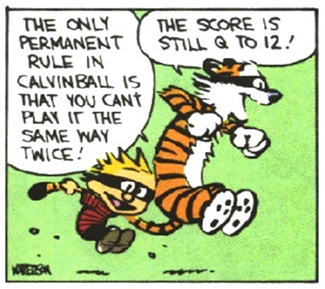

One of my favorite comic strips was Calvin and Hobbes. It was about the adventures and insights of Calvin, a precocious six-year old boy and his best friend Hobbes, a stuffed tiger. Like all the great philosophers, Bill Watterson, the creator of Calvin and Hobbes, made us look at ourselves from unique perspectives. Unlike philosophers of old, Calvin and Hobbes made it a point to have lots of FUN in everything they did. Some of my favorite Calvin and Hobbes adventures involved a game they developed called Calvinball. When someone asked Calvin how to play, Calvin replied “It’s pretty simple: you make the rules up as you go!” I suspect I have created a nostalgic craving for Calvin and Hobbes for some of you, but others may be asking “What does this have to do with financial planning?” As I was trying to figure out what to write about, I started thinking about some situations I have helped our clients work through. A few recent examples came to mind: the settlement of an estate, estate planning involving second marriages and planning for the care of a child with special needs. The common denominator in all these situations was the use of trusts to accomplish our clients’ goals. In many ways trusts are a lot like Calvinball--you get to make many of the rules up as you go.

One of my favorite comic strips was Calvin and Hobbes. It was about the adventures and insights of Calvin, a precocious six-year old boy and his best friend Hobbes, a stuffed tiger. Like all the great philosophers, Bill Watterson, the creator of Calvin and Hobbes, made us look at ourselves from unique perspectives. Unlike philosophers of old, Calvin and Hobbes made it a point to have lots of FUN in everything they did. Some of my favorite Calvin and Hobbes adventures involved a game they developed called Calvinball. When someone asked Calvin how to play, Calvin replied “It’s pretty simple: you make the rules up as you go!” I suspect I have created a nostalgic craving for Calvin and Hobbes for some of you, but others may be asking “What does this have to do with financial planning?” As I was trying to figure out what to write about, I started thinking about some situations I have helped our clients work through. A few recent examples came to mind: the settlement of an estate, estate planning involving second marriages and planning for the care of a child with special needs. The common denominator in all these situations was the use of trusts to accomplish our clients’ goals. In many ways trusts are a lot like Calvinball--you get to make many of the rules up as you go.

This is not to say that you get to change the estate tax, gift tax or income tax codes to suit your own purposes. (Darn. We only wish that were true!) However, you do get to make up the rules when it comes to who will control the trust, who will receive distributions, when they will receive distributions and for what reasons, and what types of investments can be owned in the trust.

Trusts are often thought of as only a tool of the wealthy: very complicated, stuffy and highly technical. In fact, trusts can be a helpful estate planning tool, regardless of the size of the estate.

Trusts are very helpful because they can provide a durable legal structure designed to meet your goals now and in the future. In the case of a client’s recent estate settlement, the development of trusts helped our client control the distribution of her estate in a private, thoughtful manner. During her lifetime, she liked being able to control and change the rules of the trust. Before her death, she told us she had a deep sense of peace because she thought the trust would help avoid any potential conflict between her grieving adult children and that neither she nor her children would need to make any financial decisions during her final days. When she died, all the assets in the trusts by-passed the probate process, remained out of the public record, minimized post-death fees and transferred large portions of our client’s estate to the beneficiaries in a timely manner.

In another recent case, a trust helped achieve the estate goals of a client that has children from a first and second marriage. She wanted to make sure that when she died her current husband and child from her second marriage would be financially secure. She also wanted the children from her first marriage to receive a portion of her estate. Both these goals were accomplished by creating a trust. Her attorney created a trust for her and most of her assets were transferred into the trust. At her death, the trust directs that her adult children from her first marriage receive specific dollar amounts. After those distributions, the income from the remaining assets of the trust can be used by her current husband for the rest of his life. He can access the principal of the trust for his general financial needs. At his death, the trust will be left to their child.

Another example of using a trust and “making the rules up as you go”, is a case where our clients had three adult children; for this example we will call them Sam, Abby and Andy. Sam is married with two kids of his own. He has a good job and is becoming financially successful in his own right. Abby is a newly divorced single mom with a son. She has difficulty managing her finances. Andy has a diagnosis on the Autism spectrum. He is receiving disability benefits from Social Security and government health benefits. Andy is semi-independent but will probably need some level of care for his life. We worked with our clients and their attorney to develop a solution that involved the use of several trusts. Our clients developed “the rules” of each trust to reflect the unique circumstances and needs of each beneficiary. For example, Sam’s inheritance would be held in trust, but distributed outright to him as he reached certain ages. Abby’s share of the inheritance will be held in trust and will be out of reach of her current ex-spouse, any future spouses and not available to any creditors. At her death, the assets of the trust will be for the benefit of her son and her older brother will be the trustee. Andy’s share will be held in a special needs trust

that will not endanger his government health benefits or Social Security disability benefits. The trustee will control the distribution of Andy’s trust and will use the assets to enhance his life experience. Expenses like the purchase of airline tickets for visits (particularly over the holidays) with his siblings and Cincinnati Reds season tickets are specifically outlined in the trust as expenses the trustee should embrace.

The key to “making up the rules” of your trusts is to be able to answer the questions of Who, What, When, Where and Why. Determine “who” you would like your trust to benefit and who will control it. Establish “what” the trustee should and should not do with the assets. Choose “when” the assets of the trust will be distributed to the beneficiaries. Know “where” you would like the assets to be managed. Lastly, ask yourself “why” you are using the protections a trust can provide. Is it to protect the beneficiary from themselves or others? Is it to disburse your assets in a unique manner? Once you have some answers in each of these areas, write them down and give us a call. We can work with you and your attorney to coordinate the “rules” you made into a workable legal document. Using trusts in your estate plan can benefit you now and your beneficiaries for years to come. Trust planning shouldn’t be intimidating. Trust us. You can make up the rules as you go!