The first quarter of this year was the strongest for stocks since 1998. International stocks, as measured by the MSCI All Country World ex-US index, were up 10% in the quarter and US stocks, measured by the Russell 3000 Index, returned 14%. Given current elevated valuations, one might reasonably expect it could normally take two or more full years to generate that much return! At the same time, interest rates declined, and bonds returned about 3%, representing approximately a full year of bond returns in just one quarter. Not to be outdone, the REIT index returned a blistering 17% in just the first three months of the year.

In isolation, those results would be truly remarkable. But the context is that those very strong results followed similarly weak returns in the fourth quarter of last year. Put together, this strong quarter nearly reversed the prior quarter’s declines, but that’s about all. As such, all that really occurred is that the market declines of late last year have been mostly repaired about as quickly as they occurred.

Also reversing this quarter was the market leadership of Value stocks relative to Growth stocks. In the declines of the 4th quarter, US Value stocks fell 2% less than the overall US market (Russell 3000 Index) while Growth stocks declined 2% more than the market. In the first quarter of this year, that too switched, as US Growth stocks outperformed the US market by 2% and Value stocks lagged by 2%. Recall that considerable research has identified Value as the characteristic in stocks that has historically added the most excess return in the long run. But Value also typically lags in strong markets, and the first quarter certainly qualified as a strong market.

Market participants always have a list of economic and political concerns on which to fixate. Currently, top worries include whether England will exit the European Union with or without a trade agreement, and whether trade brinksmanship by the US toward China will result in a deal in which China plays more fairly going forward or, failing that, whether tariffs slow the economy enough to cause a recession. In each case, a no deal scenario is not in the interest of either party, so the worst-case outcomes are probably not the most likely, but we’ll have to see.

Another perennial concern for markets is the Federal Reserve. At year end, there was a great deal of worry that this year the Fed might raise short-term interest rates enough to trigger a recession. But the Fed’s consideration of each of the trade skirmishes mentioned above has led it to recently announce that additional rate hikes this year are not in the cards, essentially removing that concern for markets at least temporarily, and propelling much of the market’s recent strength.

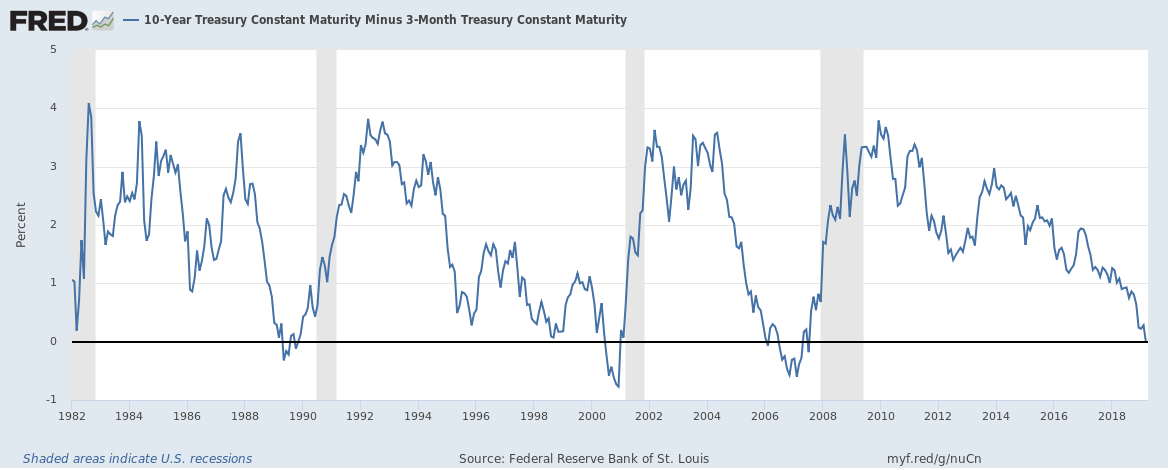

The Fed’s recent actions and statements have been a catalyst for a sharp decline in long-term interest rates, causing the yield on 10-year Treasury bonds to drop temporarily slightly below the yield on 3-month Treasury bills. This condition, known as an “inverted yield curve”, has suddenly grabbed a place among the market’s list of top worries since, historically, an inverted yield curve has generally preceded recessions by a year or two.

History of the Yield Curve (10 Year minus 3 Month Treasury)

Markets always see risk somewhere, but remember that 1) if there were no risks, stocks would not produce better long-term returns than bonds, and 2) the biggest market moving risks are seldom the ones that markets fixate on, rather, the biggest market movers are the surprises that pop up from time to time, seemingly from nowhere. So, given that surprises cannot, by definition, be anticipated, and that the known risks are already “discounted” into market prices, it is not beneficial to position portfolios based on guesses on such matters as Brexit, China trade talks, Federal Reserve Policy or the impact of an inverted yield curve.

Instead, what actually is highly beneficial is to focus on developing and enlarging the quality of patience. Warren Buffett often extols the virtues of patience in the field of investing, and for good reason – no other attribute better differentiates successful investors from those who are their own worst enemies. Sometimes patience is required to endure declining markets, as was the case in the fourth quarter. Sometimes patience is required to stick to the discipline of value investing and trust its long-term demonstrated success when value stocks have significantly lagged the market as in recent experience. But nothing is as rewarded in long-term investing as patience and nothing is a bigger impediment to long-term investing success than a lack of that trait.

We are patient, long-term, disciplined investors. Occasionally a mistake in our investment thesis is discovered shortly after an individual investment is made, and the position is eliminated relatively quickly. That may appear to belie a lack of investment patience when it really just reflects new information and a revised opinion. The patience that matters for investment success pertains to much larger matters: it is the patience (and, of course, discipline) to hold stock positions and rebalance into more stocks when one is deep into a bear market, and it is the patience (and discipline) to take the long-term view of value investing after value has underperformed for an extended period. Recognition that stocks outperform bonds in the long run and likewise that the value style outperforms the market in the long run are not notions about which a successful investor will change their mind with the addition of a new data point, or several.

Markets were spectacular in the first quarter of this year, but the patient, long-term investor does not see that as cause for any particular exuberance. This is first, because in the long scheme of things, the nice returns of the first quarter are really just a little blip, and second, because when asset prices advance faster than underlying fundamentals, that just means that the long-term future return will be slightly less.

Thank you for the confidence you have placed in us. We never take that for granted, and we execute that responsibility with seriousness and humility.