Earlier this year, we experienced the quickest adjustment in history from new market highs to bear market decline. It all occurred in 32 days, from 2/19 to 3/23. Since then, there has been substantial but incomplete recovery as markets both responded to stimulus and anticipated recovery in the economy. In the second quarter, stocks experienced their strongest quarterly performance since 1998. That bounce, however, still left broad markets below their former highs and was concentrated in April and May while June was choppy in the face of a resurging virus that increased uncertainty about economic recovery in unprecedented times.

Health Dimension

April and May generally brought declines in the number of identified new COVID-19 cases even while testing significantly ramped up, and after peaking in mid-April, the number of deaths began to fall even faster. Those two months experienced unambiguous improvement in the health data. As to the economy, April and May also brought numerous indications of the beginning of recovery, and the last two monthly employment reports showed surprising and remarkable resilience in the US.

June has been more complicated. New cases flattened in the first two weeks of the month and then surged in several states, including California and most of the South. However, in a contradiction not fully understood, COVID-19 deaths have continued to decline. Most or all of that may be explained by the inherent time lags (and the next few weeks will tell in that regard). But there is also increasing anecdotal evidence that the older, more vulnerable part of our population has learned to better protect itself and that most of the infection is now occurring among younger individuals with less severe consequences.

Additionally, as the average length of hospital stays associated with the virus has been cut approximately in half, there is increasing evidence our healthcare system is better learning how to treat this disease, perhaps including the impact of newly available drugs. Given these crosscurrents, this is a time of extreme uncertainty regarding the health dimension of this crisis. Even as hopes for a seasonal decline in the disease fade, there rises some reason for optimism that we may be adapting better to protect the most vulnerable among us and that for whatever reason, the aggregate consequences of the illness may have diminished.

Over 100 vaccines are in expedited development with several now entering or soon to be entering the last phase of clinical trials. To further compress the time frame, some manufacturers have begun mass production of their vaccines even before proven or approved, bearing the financial risk of that choice in order to further shorten the timeline. Many people have hung their hopes solely on arrival of a vaccine and see that as the critical event to exiting the health crisis. That may prove to be the case, but we would caution that a vaccine may not stop the disease. Note that even though we annually have a vaccine for seasonal flu, we still generally experience between 12K and 61K deaths annually from flu in the US. On the other hand, while we have had diseases essentially eradicated by vaccines, we’re unaware of any pandemics that have been addressed by a vaccine, and all pandemics through history have ultimately fizzled out on their own. Arrival of a vaccine will certainly be welcome, but it may be neither a necessary nor a sufficient condition for economic recovery.

Economic Dimension

Uncertainty about the timing and effectiveness of a vaccine is just one unknown regarding the health dimension of this crisis, all of which directly impact economic uncertainty, adding to other unknowns including the ultimate impact of monetary and fiscal stimulus. Some of these unresolved questions include the degree to which experience with working from home may or may not have a lasting impact on many things including commercial real estate, the degree to which supply chains may pivot from just-in-time to just-in-case, the point at which levels of government debt will start to matter, the ultimate impact of the Federal Reserve’s actions on inflation, and on and on. Chairman Powell of the Federal Reserve recently stated this is a time of extreme uncertainty and in that he was not just seeking to manage expectations. A famous observer once said, “There are decades where nothing happens, and there are weeks where decades happen.” We’re clearly experiencing change at the rate of the second part of this quip.

Market Dimension

Markets don’t like uncertainty, and these unknowns don’t seem likely to dissipate soon, so that weighs on stocks now and adds to volatility, amplifying market reaction as data unfolds. On the other hand, markets are buoyed by low interest rates, low inflation, and money creation, each of which seem likely to be with us for yet some time to come. For now, these are two powerful, contradictory influences, sometimes in balance, sometimes not.

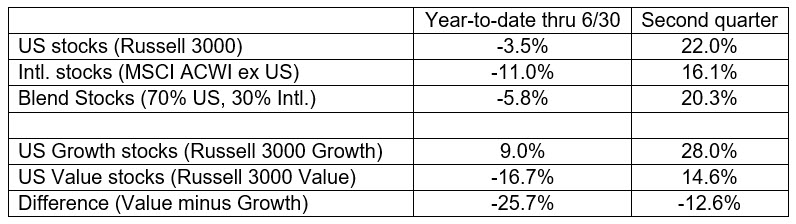

As always, these near-term forces play out against a longer-term backdrop, and the most important determinate of long-term market returns is the current valuation of the market. By any of the standard measures, the overall stock market is extremely over-valued right now. But that simplification masks an important undercurrent: as we have mentioned here before, the stock market is as bifurcated today as it has ever been with a few handfuls of very popular but expensive companies pulling away from the others and leaving a substantial segment of quality stocks priced at compelling valuations. That fact is uncomfortable for those having held reasonably priced stocks that have gotten cheaper, but the opportunity in those holdings going forward looks as enticing as we have seen. Here are the market returns over the past quarter and year to date:

Not shown in the table are bonds, which were positive both this year-to-date and in the second quarter as interest rates fell; REITs, which were up 13.3% in the last quarter, but remain down 13.3% year-to-date; and real assets, which were up less than REITs for the quarter, but down less than REITs so far this year. Also not shown are small US stocks, which were a little stronger than large stocks in the second quarter but remain down 12.9% year-to-date.

All that should be about as expected: stocks dropped sharply in anticipation of a sudden decline in economic activity due to mandated, health-related shutdowns followed by a strong but slower recovery in stocks in anticipation of an eventual economic recovery while small stocks and, in this case, REITs traced steeper declines and international stocks followed a similar but somewhat different pattern. None of that is remarkable. What is most remarkable about this year is the degree to which Growth stocks and Value stocks have diverged as Growth stocks outperformed Value stocks this year to date by an astonishing 25.7%, something that has happened for a full calendar year only once before - in 1999, at the end of a strong run for Growth stocks and the beginning of a period of strong outperformance for Value. This is precisely contrary to the long-term history as from 1927 through 2019, cheap, unpopular stocks have outperformed expensive, popular stocks by more than 3% per year in the US, on average, even though they have sometimes lagged for extended periods.

Overall stock valuations were quite expensive by all the usual measures as the current crisis began, and have just gotten more extended as the crisis developed. Yet, with exceptionally high levels of uncertainty about the health crisis, the economy, and markets, there exists a significant opportunity created by the extreme divergence in the performance of Growth and Value stocks. (For more on the history of Value and the current extraordinary opportunity, including the relationship of this opportunity to market concentration in a few popular, very expensive stocks, see this link to our recent article: Embracing Value.)

The scale of this divergence has produced an opportunity in Value stocks not seen in more than 20 years. Moreover, the current degree of market concentration points to a level of extremity that in the past marked a turn in the relative performance of Value over Growth. In markets, there are historical probabilities but no guarantees. By several different measures stocks overall are very expensive. What unavoidably follows from that is that long-term return expectations for the stock market from this point look unappealing. Yet at the same time, expectations for the relative returns of Value stocks have not looked this good since the end of the last century.