Another month of the COVID-19 crisis is behind us with the Russell 3000 index of US stocks returning 7.25% – its best showing for August in decades (non-US stocks were up 4.3%). That return for the broad index of US stocks followed a 5.7% return in July, 12.3% in June, 5.35% in May, and 13.2% in April. March, of course was ugly. The most common question we’ve gotten lately is: How can the market be so strong with the economy so bad?

You know this has been a health crisis, an economic recession, and a market crisis, so we’ll address each in turn to answer the question. From the end of July through the end of August, average new cases of COVID-19 declined by 36% from about 65K new cases per day to about 41K per day most recently. Over the same period, deaths declined 21% from nearly 1,150 per day to a weekly average of 905 per day at the end of August. Along the way, new cases flattened for over a week in the first half of August and the past few days look like it may be flattening again. But the trends in new cases and in deaths have clearly been down, the declines have just been too slow. Vaccine development, on the other hand has been remarkably fast, with nine in the final stage of clinical trials with none of which we are aware having failed. Most guesses now seem to be that there may be approvals along with some availability for the most at risk perhaps as early as late November. Improvements are evident on the health front with more expected soon.

As to the economy, the Commerce Department’s most recent projection for second quarter Gross Domestic Product (GDP) is an annualized decline of nearly 33%. Industry projections for the third quarter were largely revised upward last week generally to about +30% annualized (within a wide range). But extra unemployment benefits expired and near real time economic data such as Open Table bookings, employees on Homebase, and Apple mobility data point to flattening or at least slowing growth in August with economic growth in the fourth quarter more uncertain. Still, there has been over $6 trillion of liquidity injected by the Federal Reserve, $3.3 trillion of government fiscal stimulus, and $15 trillion of additional monetary and fiscal stimulus worldwide. This has combined with progress toward vaccines to make the bear market in stocks a short one and could make the recession unusually short as well. We’ll see - we won’t know until well after the fact.

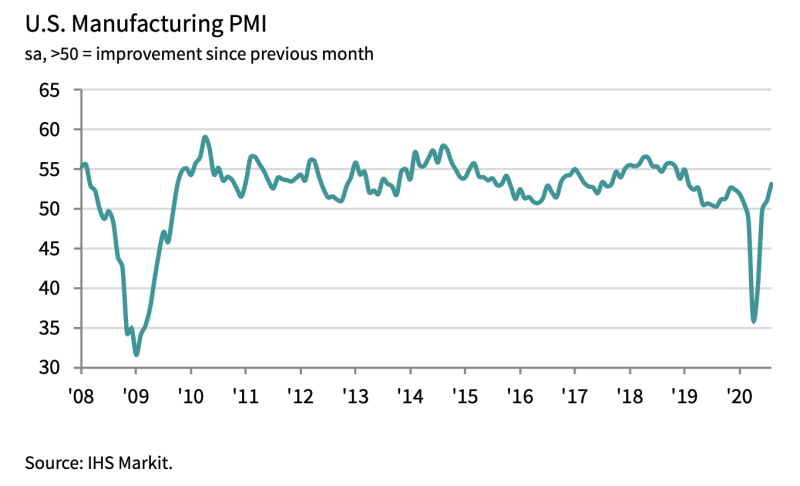

There was an abundance of speculation a few months ago about what shape the recovery would trace. The letters “V”, “U”, “L”, and “W” were the usual suspects. Services (especially travel and hospitality) and employment still have a long way to grow to complete a recovery, but with respect to manufacturing, the recent Manufacturing Purchasing Managers Index released by the Institute for Supply Management settles the answer as a “V” (so far):

Per today’s August unemployment report nearly 1.4 million jobs were recovered last month, bringing the unemployment rate down to 8.4% (versus 9.8% expected and 10.2% a month ago). The reason behind this passing strange circumstance of strong stock markets and weak economy is that awash in liquidity, the trajectory of the economy has been positive, and the pace of recovery has generally exceeded expectations. However, that’s not to say market valuations are rational. By virtually any measure, stock markets overall, and especially segments of large popular stocks, are extremely expensive. At a minimum that implies lower stock returns in the long run, and in the short-term amid extraordinary uncertainty, it raises risks.

The near-term impact of monetary and fiscal stimulus has been positive, but likely comes with a longer-term cost. Just last week, the Federal Reserve changed its inflation target in ways that imply interest rates are likely to remain lower longer. That means markets going forward may be more subject to bubbles and busts (stocks may well be in a bubble now), it means inflation may be a greater risk, and it means that both the risk control benefit of bonds and the income bonds produce going forward are likely to be materially reduced. A few months ago, Government bond rates fell to record lows and essentially stayed low so future portfolio returns are likely to be lower than otherwise, risk going forward is likely to be higher, and including diversifiers in portfolios becomes even more important.

Given the Fed’s renewed commitment to achieve somewhat higher inflation, the odds of their success in that aspiration have risen. That plus the fact that gold has been strong of late (perhaps mostly the latter) have prompted several to ask whether they should own some gold in their portfolios. We used to target a spec of gold for portfolios but sold it (in a not well-timed transaction, in hindsight) after more research revealed that for all its volatility, gold doesn’t track inflation very well in the short to intermediate-term. Furthermore, even in the very long run, gold only matches and does not exceed inflation. US Treasury inflation protected securities (TIPs), on the other hand, not only track inflation much better in the short- and intermediate-terms while generally providing a return premium over inflation, TIPs do all that with much less volatility than gold. So, we increased our target exposure to TIPs, shifted TIPs from the bond “bucket” of portfolios to the inflation hedge “bucket”, and portfolios are a bit better protected against inflation as a result.

As we enter September in a presidential election year, we can’t avoid mentioning the election any longer. For all the potential impact on tax rates and other policy, this time, we’ll focus on just one risk: what if the election is not resolved on Wednesday, November 4? Would that not make markets more than a little uncomfortable? We’re not speaking here of races too close to call, hanging chads, legal challenges, or a Supreme Court decision. Each would be bad enough, but here we’re just wondering about the time required for counting absentee ballots. Given recent trends, it’s estimated that as many as 30% of ballots would have been mail-in this time even without COVID-19. But with the pandemic, many now expect more than half of ballots this November may be by mail. If so, they may be unlikely to be counted by the morning after election day. That much counting is more likely to take several days if not longer. In that likely event, markets are unlikely to be amused.

To that lovely thought, we’ll add another: September has typically been the worst month for markets. Except that in election years, the worst month has historically been October. As markets ride a wave of liquidity into a headwind of election concerns, we have no idea how the interaction of the two will play out, but increased volatility seems a reasonable outcome for which to steel. We’ll all be pleased when both pandemic and election are behind us and we’re grateful markets have so far bounced back as well as they have. We’re rebalancing to sell overweight equity positions where tax constraints allow and, in an increasingly narrow market, we’re even more focused than usual on broad diversification.

* “She swore, in faith, ‘twas strange, ‘twas passing strange.” -Othello