Man is by nature a political animal*

Given the country’s current fixation on politics and given our own intent to avoid that subject in these updates whenever possible, Aristotle’s remark seems a good opening to a Market Comment that has no choice but to address politics on the very eve of a highly contentious election.

But first, comments on Covid-19, the economy, and markets in brief:

New cases of the virus are exploding in a third wave - not as rapidly as in most of Europe, but with many more identified cases than a few weeks ago. Fortunately, deaths so far have not increased as much, though it is yet unclear whether that is solely due to the natural lags, if treatment and therapeutics have really improved, or if the infected population is simply skewing younger. The most important news on the health front may be what we are not hearing - as phase three trials of several vaccines progress, we have so far not heard about anything other than normal, minor setbacks, so that is likely great news - one or more safe and relatively effective vaccines is likely to fairly soon be ready. That the companies are confident enough to be currently manufacturing many millions of doses should be encouraging.

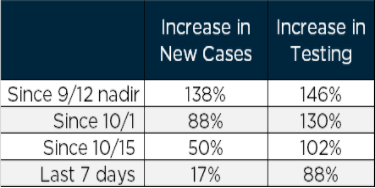

Also, this rapid rise in new cases has been widely noted, but less well known is that testing has also exploded. Per data from Johns-Hopkins, here are recent changes in 7-day averages of both new Covid-19 cases and tests:

Testing increased faster than new cases in each of these periods. The 7-day average of deaths is up 23% from its low point on 10/17, so it’s clear Covid-19 is spreading at a faster rate than it was in early September, but the fact that testing has increased faster than new cases over several time frames seems to imply that at least some of the increase in identified new cases is a function of much more testing than solely a function of increased transmission. On the other hand, hospitalizations have clearly increased, even if much less so than identified cases, so this third wave is real even if we have no good basis to compare it with the earlier waves.

The economy continues rapid recovery. Last week, record quarterly GDP growth of 33.1% (annualized) was reported. Most economic news continues to surprise on the upside. There is much more room to go before we fully recover from the damage earlier this year – large segments of the service sector remain devastated. On the other hand, housing, retail sales, and autos have more than fully recovered and are setting new records. Where possible, businesses are learning to adapt and carry on. The economy was very strong before the self-imposed but generally considered necessary recession, and it is bouncing back nicely. At each point along the way there have been some saying the recovery has been good so far but now looks to be slowing. So far, that has not proven to be the case. If the advent of vaccines is soon, that should only continue to bolster growth and optimism. The Federal Reserve continues to have room to remain very accommodative, and whether we truly need it and can afford it or not, more fiscal stimulus may be coming after the election.

As to markets, last week brought a surge in market volatility and the worst week for the S&P 500 since March – falling more than 5.6% with the largest, most expensive technology stocks hit hardest. For the month of October, the S&P 500 Index declined nearly 2%, its worst performance since March and its second down month in a row. As we have repeated, this is a period of extraordinary uncertainty, and heightened volatility reflects that.

On election eve, political uncertainties loom exceptionally large. Amid intense partisan division, both sides point to the dire consequences to civility and even to Liberty and to Justice should the other side win. In many respects, those dire concerns may be fair, but with respect to markets and to the economy, we would note that there is always a tendency to ascribe much more blame or credit for the economy to the president than is merited. Many think the choice of president will have immediate consequences to the economy (and to markets) for good or ill. In fact, it’s not nearly that simple. For one, what occurs with the Senate and the House will be at least as consequential as the presidential outcome. Specifically, if a president seeks tax policy that markets would not favor, that is largely eliminated as a concern should the Senate remain in the hands of the other party.

A sweep either way could result in unrest, higher taxes, or both. But most think the worst outcome from a market perspective would be a contested, too close to call, drawn out election. You’ve heard the fears: an Electoral College tie; or weeks to count absentee ballots in states too close to call otherwise; or even recounts and allegations and no decision outside of a Supreme Court ruling. We can’t handicap the odds of any of those. We’ll have to just see.

As to taxes, even should the election line up so that higher corporate, income, capital gains and estate taxes seem likely, it could be that none of those apply immediately. It’s hard to imagine any Congress pushing through higher taxes until the Covid-19 pandemic has subsided and the weaker parts of the economy are improving, a condition that’s likely several months in the future. In the meantime, there is the likelihood of more stimulus, the arrival of one or more vaccines, and a continued accommodative Federal Reserve which coupled with the removal of election uncertainty could even combine to result in stronger markets post-election regardless the outcome (yes, even should the “worst case” occur, however you may individually define that). That’s not our forecast – we have no basis for that. We just raise that as a distinct possibility in this most unusual of years.

Emotions are running too high to imagine any election outcome that does not result in some form of market fireworks at least initially (up or down, maybe both). And we are all weary. We’re weary of the virus, of the election, of the high drama. We get it. But that is still no excuse to abandon a long-term investment plan because of anything as fickle as politics and as notoriously hard to understand as the interaction of politics and markets.

*Aristotle, Politics, Bk 1. (Note, Aristotle was actually referring to mankind’s propensity to sociability).