We’re all familiar with budgeting—allocating your expenses to stay within your income. But once your regular expenses are covered, how do you budget what’s left over? This article will focus on your options to save money for long-term goals, and the financial and tax benefits of each.

Emergency Fund

The foundation of a healthy financial picture is an emergency fund. This should be large enough to cover at least six months of basic living expenses. Nobody could have predicted 2020 – with restaurants and even hospitals on lockdown, we all learned just how fragile employment could be. The second crucial factor of your emergency fund is that it should be liquid, in cash or a money market account. Imagine being laid off in March of 2020, with your emergency fund invested in a stock market that lost 30% of its value seemingly overnight. You would suddenly be faced with only four months of savings, versus the six you thought you had planned for. Preferably this money is in a dedicated account separate from your everyday checking.

Retirement

After filling the emergency fund bucket, it’s best to shift focus to tax-advantaged savings. The first place to look is your company’s retirement plan. This could be a 401(k) plan, or a 403(b); they are essentially the same, but the 401(k) is for for-profit companies, while the 403(b) is designated for non-profits. If a match is offered, this will offer an instant return on your investment. Even if the match is offered at 25-50% of your contributions, you are realizing an immediate benefit. Once you invest the funds, the rate of return can continue to improve as your investments grow through the years.

The maximum amount an individual can contribute to their 401(k) in 2020 is $19,500, and is the same for 2021. If you are age 50 or older, you are able to put in another $6,500 per year as a “catch-up.” These maximums do not include contributions from your employer, although the sum of all contributions for 2020 may not exceed $57,000 ($63,500 if 50 or over). In 2021 employers can contribute an additional $1,000, for a total combined contribution of $58,000 ($64,500 if 50 or over). For more on 2021 contribution limits, see our recent article.

Government and non-profit employees – including many hospitals – may also have access to a 457 account. This functions like a 401(k), however it offers the potential for additional savings, as the annual limits are independent of your contributions to a 401(k) or 403(b). For 2020 and 2021, these are also $19,500 per person.

Separate from employer-sponsored retirement accounts are Individual Retirement Accounts, including Roth IRAs and Traditional IRAs. Roth IRAs allow you to recognize powerful tax savings in retirement, and along the road as you rebalance. Dollars are contributed after you have already paid taxes on them; in exchange, they grow tax-free and are not subject to taxes when withdrawn. If you contribute $7,000 this year, earn an average 6% annual return, and never contribute another penny, your money will be worth over $53,800 dollars in 35 years – and none of it will be subject to tax. Roth IRAs also do not require minimum distributions at age 72, so your money can continue to grow through retirement and pass to your heirs tax-free. One potential drawback is the income threshold. Roth IRAs are only accessible for those making less than $139,000 (single) or $206,000 (married filing joint) in 2020. If you make more than these thresholds, there is potentially an opportunity to make two-step Roth contributions; this is a great strategy to discuss with your financial advisor.

While the Roth IRA grows after-tax dollars, the traditional IRA provides a pre-tax retirement account for those without access to an employer-sponsored plan. The funds also grow tax-deferred until retirement, but are subject to income tax at disbursement and required minimum distributions upon reaching age 72. These accounts are subject to the same annual funding limits as Roth IRAs ($7,000/person in 2020 and 2021), and contributions must be coordinated between all IRA accounts you own.

Tax-Advantaged Savings

In addition to traditional emergency funds and retirement savings, there are a few newer ways to grow focused savings in specialized accounts, including Health Savings Accounts (HSAs) and 529 accounts for education savings.

HSAs are available to those in a high-deductible health plan (minimum deductible of $1,400 for individuals and $2,800 for families in 2020). They are triple-tax-advantaged: dollars go in pre-tax, grow tax-deferred, and distributions are tax-free if used for eligible medical expenses. Although you could easily use the money to pay for routine medical bills, the power of the HSA is realized when the funds are untouched and invested for many years. A few ideal uses for these funds later in life include paying for long term care insurance premiums, reimbursing your Medigap/Medicare insurance premiums after age 65, or to purchase health insurance to bridge the gap between early retirement and Medicare eligibility at age 65. A $3,550 investment today could grow to over $27,0001 to pay for medical expenses in retirement – tax-free.

529 accounts offer an additional avenue for saving. These contributions also grow tax-deferred and are tax-free if used for qualified education expenses. College tuition, fees, and required expenses are eligible (including room and board). K-12 tuition, as well as some apprentice and trade schools, now also fall under the umbrella of 529 eligibility. Each state offers their own 529 plan. It’s worth looking into the plan offered by your state of residence, as some also reward contributions with a tax break on state income taxes. Currently, contributions to the Ohio 529 plan by Ohio residents are eligible for a $4,000 reduction in taxable income – per beneficiary. If you have four kids, you could shelter up to $16,000 per year from state income taxes by utilizing a 529 plan to save for college expenses!

To coordinate all the moving pieces, let’s take a look at an example:

Dr. Jones has been a physician for three years. She works full-time in a busy university Emergency Department, and twice a month picks up extra shifts at an urgent care. The university offers a 403(b) with a 3% match, as well as a 457 account; she earns $500,000/year. The urgent care offers a 401(k) with a 4% match, and she earns $2,500/month.

Assuming Dr. Jones already has six months of living expenses in a savings account, she should first make sure to take advantage of the two employer-provided matches. She will contribute $15,000/year to the university 403(b), and the hospital will match with an additional $15,000/year. Next she should turn to the urgent care match. If she contributes $1,200, her employer will match the $1,200. These two accounts are coordinated; when she is ready to start saving more to her university 403(b), she will only be eligible to contribute an additional $3,300 to reach a combined $19,500. However, her 457 contributions do not get included in this calculation. She can save an additional $19,500 to the university 457. At the end of the year, between her savings and the employer matches, she will have an additional $55,200 of tax-advantaged assets saved for retirement! She may still contribute $6,000 to an IRA account, $3,550 single / $7,100 for family to an HSA, and designate funding to at 529. The “alphabet soup” of savings can be confusing to navigate, and an advisor can help determine the best accounts to put away your hard-earned money.

Additional Savings

Although tax-advantaged accounts get most of the glory, a traditional taxable investment account offers many of its own benefits. Taxes must be paid as assets are sold and the portfolio is rebalanced; however, those tax rates are significantly lower than the rates of earned income. In 2020 the top tax rate is only 20%, compared to the top tier of 37% for wages!

Taxable accounts also offer opportunities for strategic tax planning. With the 2020 Required Minimum Distribution (RMD) “holiday” afforded by the CARES Act, those with savings in non-retirement accounts were able to continue to live their lifestyle from capital gains assets. By selling stocks and bonds to fund their living needs, they may be enjoying a much lower tax burden than usual come April 15th.

If you find that you are maximizing your savings, but are charitably inclined and seeking tax benefits, a Donor Advised Fund might be a great fit. This works like a personal giving account. Money is contributed in one tax year (and you take the tax deduction at that time), then you are able to give gifts out of it until the funds are exhausted. The best way to utilize this is to lump gifting for multiple future years into one year, itemize deductions on your tax return, then continue to gift while dropping back to a standard deduction. This plan is best discussed with your tax professional, and your financial advisor can help coordinate.

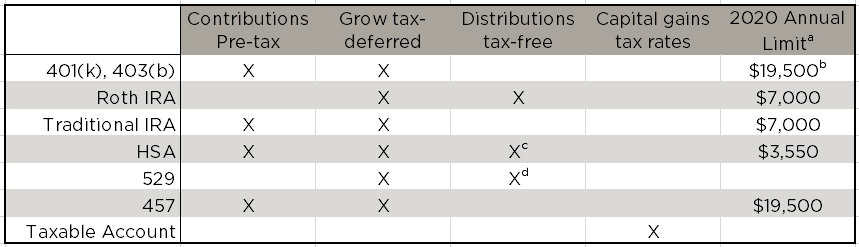

This table provides a high level overview of the different accounts discussed:

a 2021 Annual limits are discussed in more depth Here

b Plus an additional $6,500, if age 50 or above

c If used for eligible healthcare expenses

d If used for qualified education expenses

Your hard work has afforded you the opportunity to save, now make your dollars work hard for you. Take advantage of the tax benefits offered by these accounts and know that the team at Foster & Motley is always ready to strategize to help you reach your goals.

Footnote:

1 Assumes 6% annual growth, over a 35-year period