“Do not save what is left after spending, but spend what is left after saving.”

-Warren Buffet

It may not be fun to decide between funding current hobbies and putting aside money for goals potentially decades away; however, small sacrifices today can add up to a nest egg that affords the flexibility and means to live your golden years in comfort and style. Setting your savings on autopilot today, whether through payroll contributions or by automatic bank transfers, can help prioritize long-term saving.

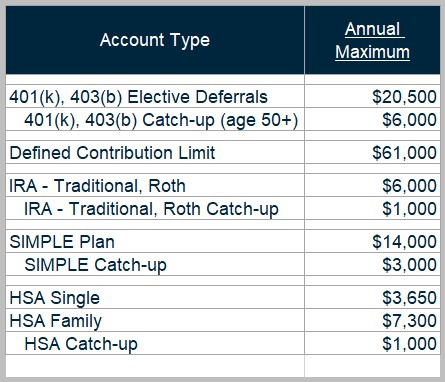

In recognition of the importance and challenge of this task, the IRS rewards income deferral with tax benefits – but there is a limit.

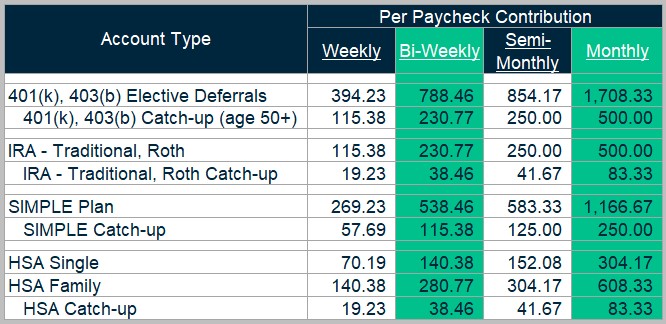

The limits to tax-advantaged accounts are adjusted annually to account for inflation. The IRS recently announced new maximums that will be in effect for 2022. Although it’s certainly possible to front-load contributions and max out contributions in January, most people find it more convenient to spread the savings out equally throughout the year. If you are interested in setting up deposits based on your paycheck cycles, these are the amounts you can use:

For more information on the different types of savings accounts, uses, and benefits, check out our article on Budgeting the Excess.

It’s important to note that the IRS takes the term maximum seriously. Making contributions over the annual limits can have significant financial consequences. Before setting up any automatic contributions, confirm with your company’s human resources contact if contributions will stop automatically once the limits have been reached. If not, the numbers shown in this table should be rounded down to avoid penalties.

We recognize it’s not always possible to contribute the maximum in each account type every year. The team at Foster & Motley is qualified and can help you prioritize your savings buckets based upon your unique circumstances and goals. Contact us today.