There are two main types of business entities in the United States: C Corporations and various pass through entities, including LLCs, S Corporations, and Partnerships. We focus on tax reform for C Corporations, which are the large well-known blue-chip companies that trade on the stock market. C Corporations are subject to an unfavorable tax structure known as “double taxation”:

- These companies are taxed as their own entities and pay income taxes at the corporate level, separate from their shareholders.

- When dividends are paid or capital gains are realized, this income is taxed to the shareholders at the individual level as well

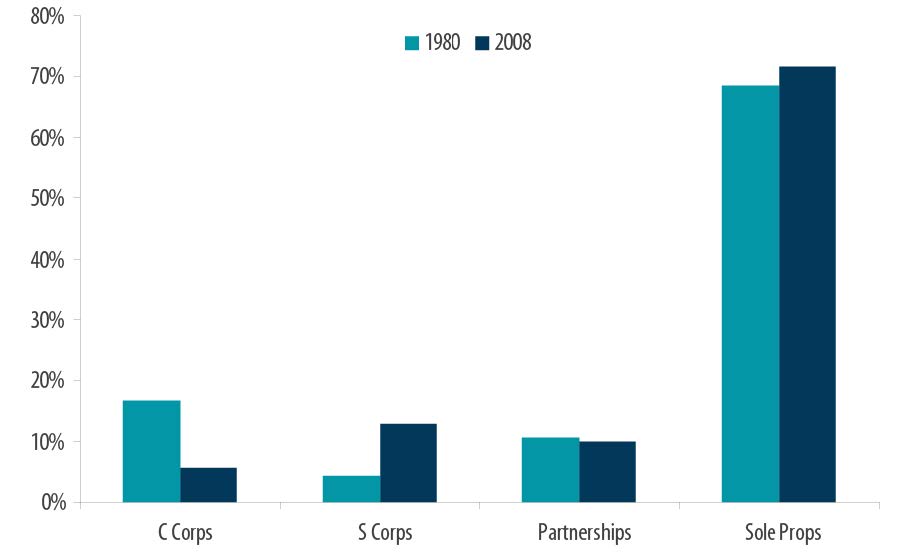

The “double taxation” structure has led to a decline in businesses incorporating as C Corporations. In 1980, C Corporations represented 17% of all U.S. businesses but are now only 6%! At their peak in 1952, corporate tax receipts comprised 32% of all federal tax revenue and over 6% of GDP. By 2016, corporate tax receipts had declined to 11% of federal tax revenue and less than 2% of GDP.

Distribution of Business Types, 1980 and 2008

Source: CRS calculations from Internal Revenue Service's Integrated Business Data

Source: CRS calculations from Internal Revenue Service's Integrated Business Data

What is the most appropriate way to measure the U.S. corporate tax rate and compare it to the rest of the world? Does the U.S. have relatively high corporate taxes? Let’s break down the U.S. corporate tax rate and examine both the statutory and effective rates.

Statutory Tax Rate

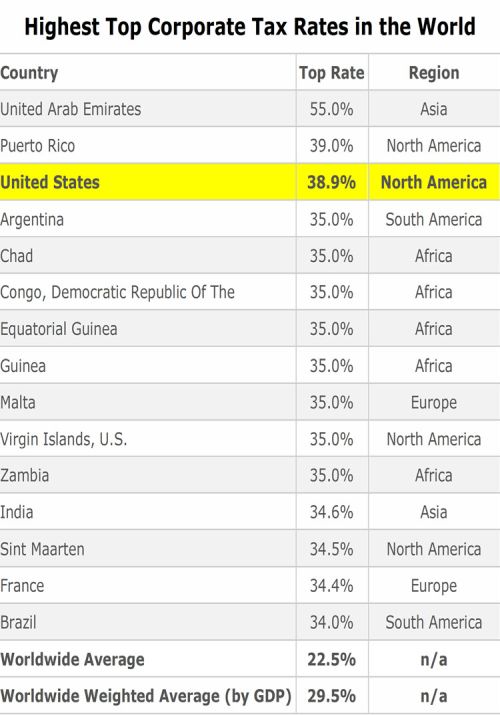

The statutory tax rate is a corporation’s tax rate prior to any deductions. Like individuals, U.S. corporations pay taxes at both the federal and state/local levels. The federal tax rate is 35%. The average rate at the state and local level is about 4% but depends on where the corporation is domiciled. When federal, state, and local tax rates are combined, the U.S. corporate statutory tax rate is 38.9%. According to the Tax Foundation, this is the third highest in the world.

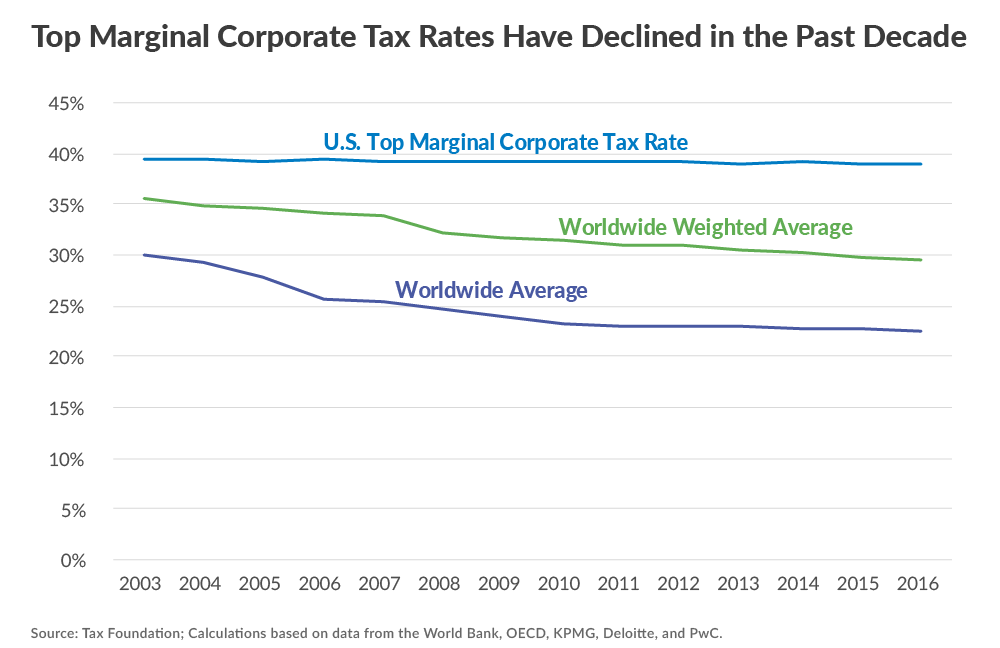

As shown in the chart below, U.S. corporate tax policy has remained stagnant while the worldwide average has been declining. 1986 was the last time there was a reduction in the U.S. corporate tax rate. The green line represents the worldwide average weighted by Gross Domestic Product, and the purple line shows the average on an equal weight basis.

Effective Tax Rates

The effective corporate tax rate is the actual tax paid divided by profits. This rate is lower than the federal statutory rates listed above. Corporations are allowed to take certain deductions to offset their income. These deductions are known as “tax expenditures”. Examples of tax expenditures include:

- Foreign profits tax deferral

- Investments in research & development

- Incentives to manufacture products domestically

- Deferral of gains for 1031 exchanges

- Interest income on state and local bonds.

The largest tax expenditure is the deferral of taxes on foreign profits. Taxes on foreign profits are only paid if the profits are brought into the U.S., encouraging companies to keep foreign profits permanently abroad. Repatriation of foreign profits at no tax or a reduced tax rate is a frequently discussed component of corporate tax reform.

The bottom line is that it is complicated to calculate the effective tax rate for U.S. companies and compare it to the rest of the world:

- A PricewaterhouseCoopers study calculated the average effective tax rate for the 2006-2007 period to be 27.7%. This rate was 5.1% higher when compared to the 34 OECD countries in the study.

- The American Enterprise Institute computed the U.S. effective tax rate at 29% in 2010, or 8.5% higher than the OECD country average excluding the U.S.

- The Tax Foundation found the U.S. effective tax rate in 2013 to be 35.3%, compared with the average of the 20 largest economies (G-20) at 24.5%.

The effective tax rate is lower than the statutory tax rate for U.S. companies but is still higher than the rest of the world.

How will a Lower Corporate Tax Rate Affect Stock Prices?

In theory, a corporate tax cut would flow directly to the bottom line of a company’s income statement. Company earnings would increase, and the valuation of U.S. companies would become more attractive.

According to S&P Global, the 2017 Earnings Per Share estimate for the S&P 500 is $129.50 with an effective tax rate of 29%. A 10% decrease in the corporate tax rate, from 29% to 19%, would hypothetically add about $18.25 in Earnings Per Share. The S&P 500 currently has a price of 2,350 and a Price to Earnings ratio of about 18. If the Price to Earnings ratio remains the same, the S&P 500 would trade at 2,660 post tax reform, resulting in appreciation of over 13%.

A cut in the corporate tax rate sounds great for stock market investors in theory, but may not work as well in practice. Capitalism is an extremely competitive economic system and excessive profits or returns on capital are generally negated through competition. Some companies will benefit from the tax cut more than others depending on the strength of their business and their mix of foreign and domestic earnings. As a result, the expected near-term earnings increase from a lower corporate tax rate might not translate into long-term recurring earnings.

On the other hand, a cut in the tax rate could promote capital investment by corporations and lower prices for consumers as businesses compete. Of course, lower prices and higher capital investment will produce greater economic growth…benefitting the stock market.