All major asset classes experienced positive returns through the first half of the year with stocks maintaining their leadership role. Foreign stocks were the best performing with emerging market stocks returning 18% and established international stocks returning 14% so far this year.

This better performance versus the S&P 500, which itself is up a strong 9% through the first six months, is likely a bit of “mean reversion”. Foreign stocks have lagged the performance and earnings growth of the US over the last several years but are showings signs of improvement and their valuation remains more favorable. We believe global stock portfolios will continue to provide valuable diversification for investors. Within US stocks, growth remained favored over value, with the growth index outperforming its value brethren by over nine percentage points. The growth index was led by a handful of large well-known companies, whose prospects we feel are mediocre given their currently expensive valuation. US small stocks had the worst relative stock performance, up a “meager” 5%. Energy was in the red and the bottom performer among sectors, with crude oil suffering its worst first half performance since 1998, down 14%.

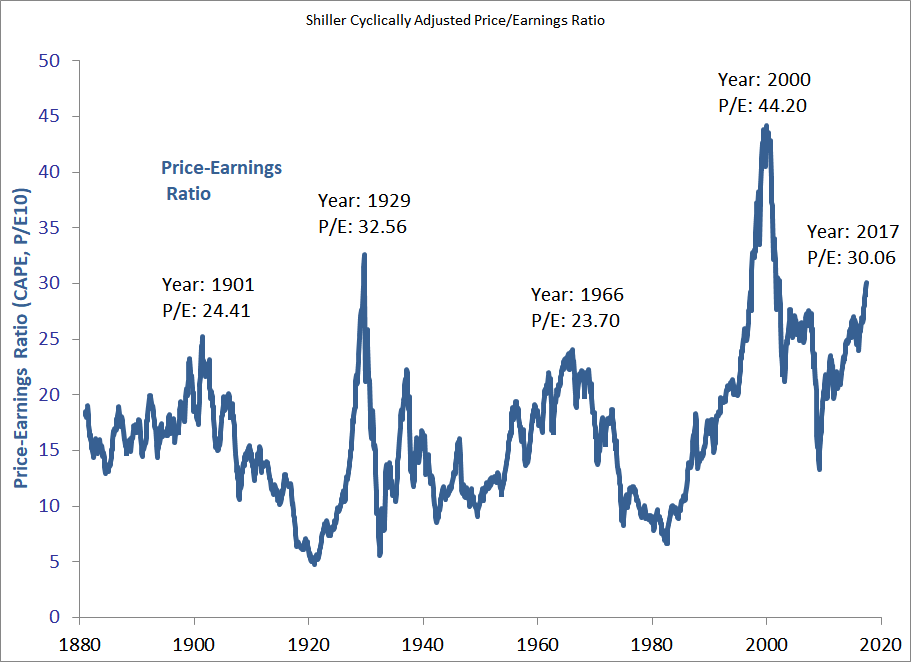

Investors have benefited from stock returns once again this year, but as we have written before, elevated stock prices come with elevated risks. As with any investment, the price paid is related to the value received and subsequent return. One measure widely used to value the stock market is the Shiller cyclically adjusted price to earnings ratio, also known as the CAPE. Company earnings can be volatile over an economic cycle, and the CAPE attempts to “normalize” these earnings using a ten-year average, adjusting for inflation. Both the current and historical CAPE is shown in the chart below.

We will first note that although it might appear to be a great market timing mechanism, it should not be used in that manner. No measure, even this one, can adequately predict how stocks will perform over short time periods. However, it does illustrate a rather rich valuation for the stock market relative to history. In fact, there have only been two other time periods where the CAPE has been more expensive, the Technology Bubble of the late 90’s and the Great Depression of the 1920’s. The conclusion drawn from this should not incite panic, but caution and lowered return expectations from stocks over the next ten years or so. We will also add that rich valuations can continue for some time, but eventually the price paid does matter.