Technology is rapidly advancing, as we have experienced both personally and professionally. Whether it is through our smartphone and mobile apps, how we consume content, or conduct business, the changes have certainly accelerated in the last 10 years. At the end of last quarter, stock sectors went through their biggest structural adjustment ever to account for this change.

Two major index providers, Standard & Poors and MSCI, are responsible for administering the Global Industry Classification Standards (GICS). GICS very simply are sectors, eleven in total. Some of these sectors are Technology, Consumer Discretionary, and Telecommunications. The major structural adjustment within these sectors that occurred was Telecommunication Services became Communication Services and was significantly expanded to include Consumer Discretionary and Technology companies. Some of the biggest shifts were that of the FANG stocks (Facebook, Amazon, Netflix, and Google), discussed in more detail below.

Why the change?

It is apparent that the way people interact and communicate has changed significantly. Long gone are the days of paying to be able to “hear a pin drop” on your long-distance calls and solely dealing with the cable company. In other words, the legacy Telecommunications Services sector became outdated. Two companies, AT&T and Verizon, focused their efforts on acquisitions and since have dominated the entire sector. AT&T purchased DirecTV and Time Warner, while Verizon acquired AOL and Yahoo.

The internet started as another way of communicating but has become a primary means of keeping in touch with people and for businesses reaching customers. The Communication Services sector will further delineate companies who are in the business of selling technology versus those who utilize technology to earn a profit. For example, Facebook is moving to the Communication Services sector, because it uses technology (i.e. the internet) to facilitate communication and sell advertising. In contrast Microsoft, who sells operating system software to businesses, will continue to be a Technology stock, according to GICS.

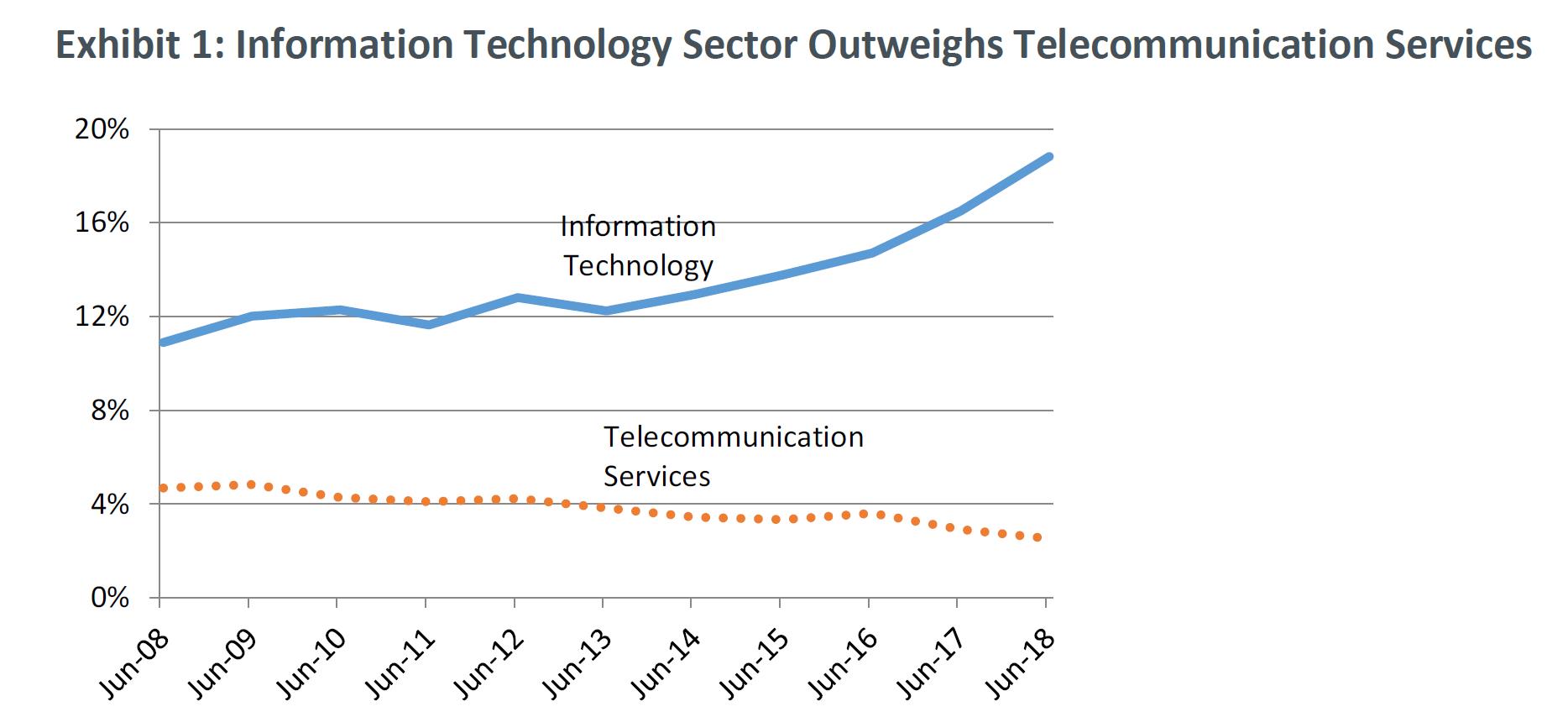

The divergence in sector weights of the MSCI ACWI Investable Market Index (IMI) between the legacy Telecommunication Services and Technology sectors is illustrated below:

Source: MSCI

The FANGs: the leaders of the bull market

As previously mentioned, the FANG stocks were included in this sector adjustment. If you follow financial media, you have probably heard about the leaders of the current bull market: FANG stocks. FANG is a media acronym for Facebook, Amazon, Netflix, and Google. Their aggregate performance has rivaled that of the late 90’s dotcom bubble and all have the appearance of being technology companies. Yet for sector reporting, the group previously was split between the Consumer Discretionary and Technology sectors. Amazon and Netflix in Consumer Discretionary while Facebook and Google were Technology stocks.

The creation of the Communication Services sector will shuffle three of the four FANGs. Now, Facebook, Netflix, and Google will join this newly created sector, bringing it into the 21st century. These FNG additions will have a significant presence, making up 49% of the sector.