Finally, your dream becomes a reality, and you have committed to traveling abroad! As the excitement fills the room for you and your travel companion(s), so does the stress. Everyone has their own reason for planning their next vacation, whether it’s to get away from their busy everyday life or explore a new part of the world. Regardless of the type of trip you’re taking, there seems to be a long checklist of tasks to complete to prepare for your travels. We hope that booking your excursion and your time spent is as stress-free and enjoyable as possible. Sometimes knowing what should be on your “to-do” list is a stressful task alone. One item that should be on the list is to ensure you are financially aware during your time away from home. Below are a few recommendations from our Foster & Motley team to consider prior to your departure to avoid unnecessary travel expenses or stressors.

Utilize a Schwab Account for Foreign Travel

Reap the various benefits of a Schwab account while traveling abroad. We recommend opening a separate unmanaged Schwab account to be used exclusively for travel. You can think of this as your travel account.

Why would you open a new account just for travel? To save money, reduce the hassle other cards may create and ensure you have a set amount of cash available. With your Schwab account you will receive a Schwab Bank Visa Platinum Debit card, which can be used as a standard debit card. A common practice for travelers is to stop at an ATM in the airport at their destination and take out cash in the local currency, which should be used for purchases when possible. Funding the account can be accomplished by transferring funds from a checking account or a previously established Schwab brokerage account. Because the account will be used solely for travel purposes, you should consider only funding it with the amount of money you plan to use on a single vacation.

As you can imagine, fees associated with travel can add up quickly and Schwab provides a low-fee option. Some of the main benefits include:

- No fees associated to open or maintain the account, and no minimum balance requirement.

- Any ATM withdrawal fees incurred will be rebated by Schwab.

- No fees for foreign exchange transactions.

You can either open a new Schwab brokerage account or a Schwab Bank High Yield Investor Checking account.

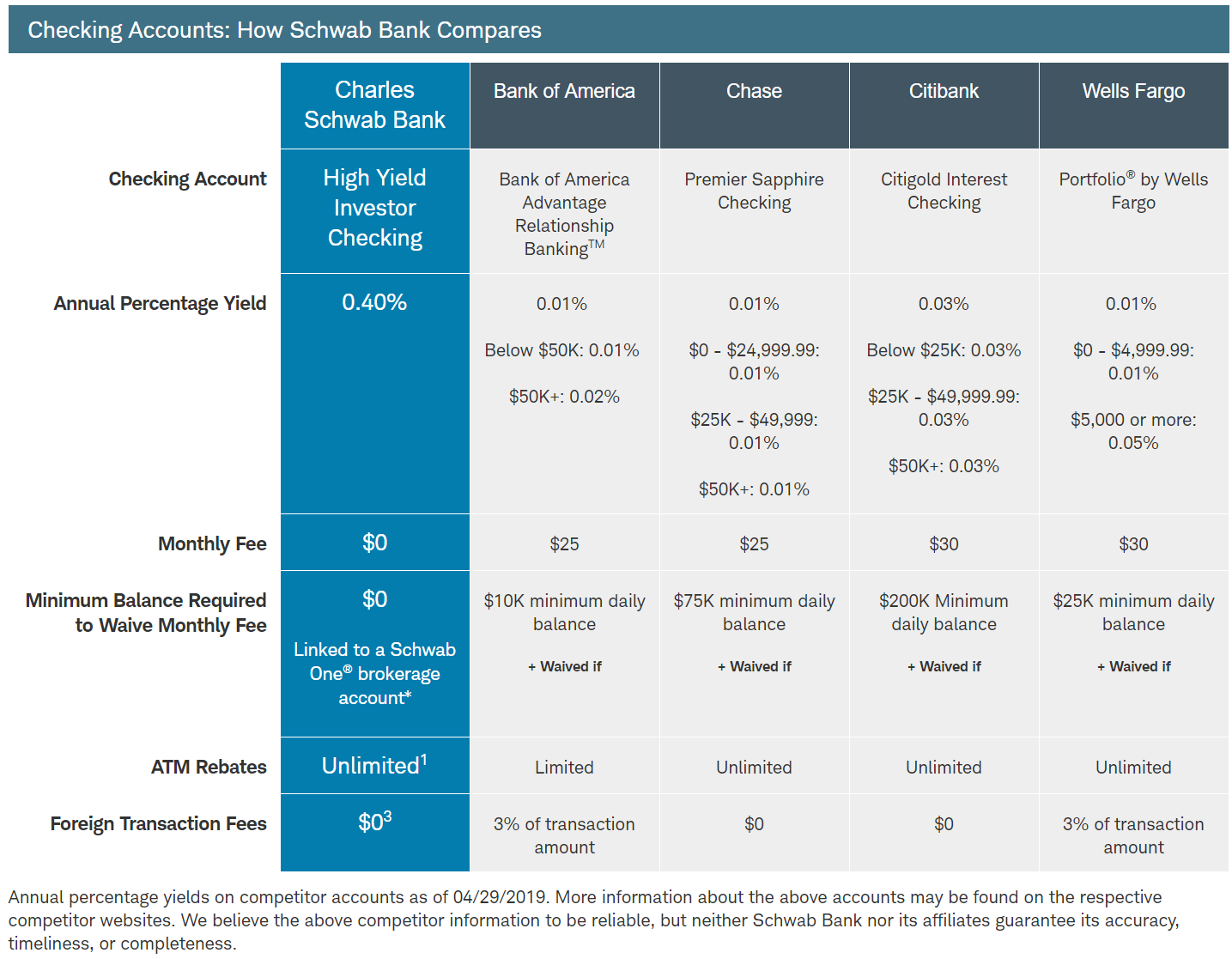

How does Schwab compare to other financial institutions? See the chart below for the Schwab Bank High Yield Investor Checking account. The Schwab brokerage account shares the same benefits as the checking account except for the Annual Percentage Yield, which may vary on both accounts.

Notify your Financial Institutions

Fraud is a topic that is and should be on everyone’s mind, especially the financial institutions that you work with. To better protect you from fraud, financial institutions monitor your transactions and will act if they notice any suspicious activity, such as charges in a foreign country (and that’s good thing!). Your financial institution may lock down access to your accounts if they believe a fraudster is using your information. To avoid this, you should notify your financial institutions and credit card companies that you will be out of the country a few weeks prior to your departure. Let them know where you are going and the dates. That way when the bank sees transactions or money being withdrawn in a foreign country, they will not lock your account(s), because they know your travel plans.

Just in case!

As with anything in life, something could go wrong, so you want to be prepared, especially when you are in a foreign area. Although we recommend using Schwab as your main form of payment, you should also bring another bank card along with emergency cash. Consider storing each financial source in a different place, such as a purse, wallet or money belt. If something happens to your Schwab debit card, you will have other forms of payment.

Travel Insurance

Another question that may be on your mind is what type of travel insurance do you need, if any? Please read one of our previous articles for more information:

Travel Insurance: What Do You Need?

Whether you have caught the travel bug and plan to take future trips or are doing a one-time voyage, we hope you have a safe and fun experience! We look forward to hearing highlights from your trips and seeing pictures.

As always, please reach out to your Foster & Motley team for more information or any questions.

Click below for a link to Schwab’s website that includes information on the Schwab Bank High Yield Investor Checking Account as well as the respective disclosures:

Schwab High Yield Investor Checking Account